How to avoid False breakouts?

6 Price action Rules that will help you avoid False breakouts

Nothing is more frustrating for a breakout trader than getting whacked by a False breakout.

We’ve all taken those trades, where we waited and waited for the setup to develop, and then after all that waiting, the stock starts inching higher and breaks through that resistance level, we fire our entry orders in the expectation that it will give an immaculate trending move, and then….

It does this.

Though breakout trading is an extensive topic, and it has different connotations depending upon who you ask. For some, simply a break of swing level is a breakout, and for some, it’s the classic – consolidation and then a break of that range, but all in all, Everyone has a basic idea of what a fakeout is, and is likely to be frustrated by it, but can we do something about it?

Like are there some methods that can help you avoid these fakeouts, at least to some extent? Well, there are! In this article, I’ll share some practical techniques that will help you avoid these fake breakouts and get a better understanding of the market’s structure.

So, let’s dive right in.

1. Avoid going against the trend

Yeah, that same old cliche advice… if you want to avoid getting trapped in a fake Breakout, don’t trade against the trend.

If the trend is up, don’t short, if it’s down, don’t long. Unless you see a strong counter-trend move that distorts the major trend.

You see, Trading is all about understanding the flow of the market, you’d have to find out whether the current flow is on the bull's side, or the bear’s, and Join the camp which has the upper hand.

If you go against the flow (what most retailers do), you’d have to endure a lot of whipsaw moves and a higher maximum adverse excursion, even if you do go right on a trade, whereas if you choose to go with the trend, the journey from the trade entry to target price will be much smoother, and a more frequent occurrence.

Let’s understand it with the help of an example.

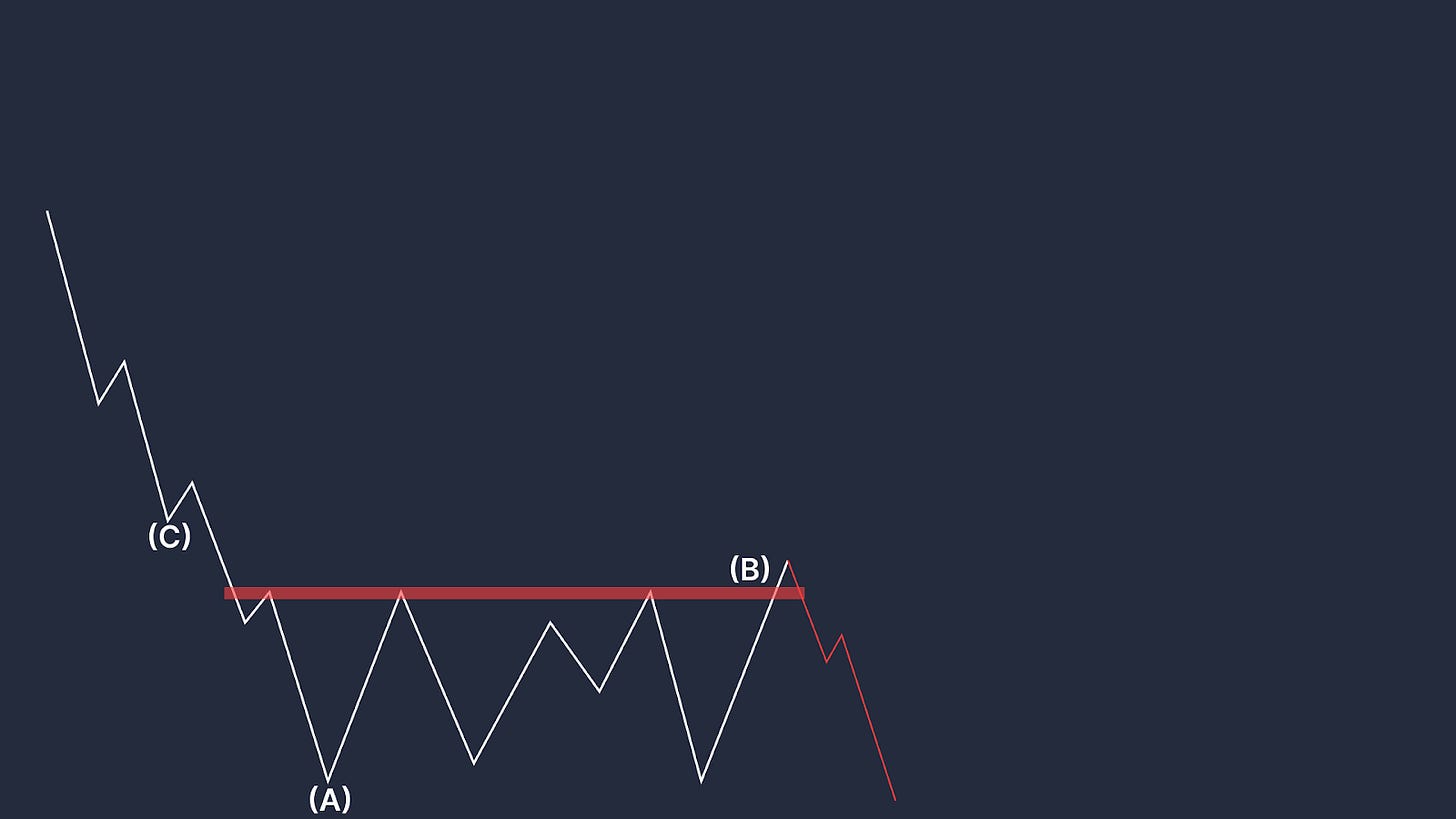

The market is in a downtrend, i.e the down moves are much stronger than the rallies, and the seller has an upper hand.

Now, around Point A the market finds some buying, and the buyers continue to absorb the selling pressure, which in turn makes the market go sideways.

Now, to a retail trader, who always has this insatiable desire of going against the trend, this seems like a perfect opportunity.

After spending some time in a volatile sideways zone, the market tries to give a Breakout at Point B, the retail traders leaped at the opportunity. The market inches a bit higher, and once this demand gets absorbed by the sellers, the market starts to tank, slowly at first, at the same time, those who’ve already bought when the price was falling (at point C) are willing to sell their shares ‘cause the stock is back at their entry price, pushing the price lower.

Once the Price fails to hold above the breakout level, the short sellers who were waiting on the sidelines step on the breakout traders' necks, and push the price lower, and the stock again starts to move towards the major trend, which was down.

And this is how you get stuck in a breakout failure.

Scenario 2: If the market didn’t find enough Supply after the breakout happens, the price will simply keep going higher, simply changing the trend from down, to up, and now any consolidation, and breakout setups, will have a higher chance of going in your favor.

2. Avoid taking breakout trades in extended stocks

I’ve written this post about how you can identify Extended breakouts using moving averages, you can check that out to get a basic understanding of the topic.

https://finkarma.in/how-to-use-moving-averages-like-a-pro

In short: An extended stock is when it’s away from its short-term averages (I use 50 MA), if a stock is up by 30-40% in the last few days, and is giving a breakout without setting up properly, i.e without catching up with its averages, the chances that the breakout will end up failing are a lot higher.

In such a case, if the price starts inching higher, without setting up(i,e without a proper consolidation), and gives a breakout, don’t take the trade, wait for it to go sideways, until the gap between the current price and the Moving average, reduces by 60-70%. I.e if the price moved about 50% away from the averages in the initial move, then you should wait for the MA to at least reach 20% below the current price, before taking a long trade. (the lower the gap between the Price at the time of the breakout and the MA, the better it is)

This will help you avoid getting trapped by these over-extended breakouts.

3. Avoid taking entries at obvious levels

You see when the Swing levels are obvious, the chances of a breakout sustaining above them reduce a lot, so if you can find methods that ensure entry before the market breaks this obvious level, you would be able to save yourself from getting trapped by fake breakouts, because when the price would break the obvious breakout level, you’d have already trailed your stop to breakeven, so even if the breakout fails to go higher, you won’t be taking any serious damage.

Then where to enter, if not at the obvious levels? for that, you’d have to find entries on smaller time frames, or pre-empt breakouts by following the price action when the stock is setting up.

For example, say if the price is making an FNP on a higher time frame, the usual thing to do will be to take an entry once it breaks the upper range of the consolidation, but if you want to avoid the possibility of experiencing a fake breakout, you can go on a lower time frame, and the time your entries better, it could be the test of the lower range, or a narrow range breakout, depending upon the setups you use.

Traders also use their pure price action understanding of the market, to avoid fake breakouts, e.g they will pre-empt their entries when the stock is in a tight range on the HTF, and start the day on a strong note (in case of a bullish setup), a gap up, or a strong rejection from the lows, are the signs of a strong start.

4. Avoid trading breakouts during the late stages of the trend.

There are 4 stages in a stock: stage 1, stage 2, stage 3, and stage 4, which are also known as Accumulation, Markup, Distribution, and Decline.

Usually, after the 3rd or 4th base the stock is considered in the late stages of a trend, though it’s not something that’s set in stone, we have to avoid buying breakouts, or at least be careful when they are setting up for a breakout during the base formation.

This is when the chances of a breakout turning into a fake breakout are pretty high.

What is a base?

In simple words, it’s a pause during a Trend, when neither the buyers nor the seller have an upper hand, and the stock experience a sideways PA, generally after giving a decent move, in an established trend.

A good base consists of at least 15-20 candles.

Like, a trend can be on a 5 min candle as well as a daily candle, these stages can also be used on any time frame.

Though, generally, they are used on a daily and weekly Time frame.

5) Scaling-in: An entry technique that is immune to Fake breakouts

Like, not 100% immunes, but yeah, it definitely is an effective technique to use when you are a breakout trader, you could say that it’s more of a risk management technique.

Normally when you see a buying opportunity, you will take full risk in one go, e.g let’s say your account size is 100k, and you risk 3% in every trade, which means that you will risk 3k per trade, and you are going to risk that 3k, in one go.

But, when you use the scaling-in technique, you basically divide the total risk into 3 or 4 parts.

Now, let’s say your system has given a buying signal in a stock at point A .. Unlike before, you won’t be risking 3% in one go, you will enter with only a fraction of the total risk, i.e 1% risk or 1k in this case.

Now, there are two possibilities, 1st is that the breakout will fail, and you will cut your position with a 1% loss. The second possibility is that the stock will sustain above the breakout level, which further decreases the chance of it being a failed breakout, so you can add the second portion of your total risk at, say at point B, and add the third portion when the stock pulls back towards the breakout level and gives a rejection, which further increases the chances of a bullish scenario being played out in the stock.

So, when you win, you win with a 3% risk (in this example), and when you lose, you will lose only a small portion of that total risk.

Now, It’s not like there are no drawbacks to this approach, this is more of a conservative though, a clever approach to managing risk, especially if you are a discretionary trader... Sometimes the stock will keep inching higher and higher without looking back, after giving the breakout, and in that case, you won’t be able to deploy your full risk on the trade, which will decrease your overall return on that trade.

6) Trade the breakout of rejection candles

This is one of the entry techniques that can help you lower the chance of getting trapped in a failed breakout.

So, when the stock is setting up, you have to wait for the strong rejection candle, a bearish candle in case of a bullish setup, and a strong bullish candle in case of a bearish setup.

It will look something like this.

The stock was in consolidation mode, and we can see it clearly taking resistance at points A and B, the stock again tries to move up at point C, but sellers pushed the price lower, resulting in the formation of a strong rejection candle.

Now, you can also observe that the volatility reduced a lot from when the consolidation started, and the volumes have also dried, up, at the same time the stock is also making higher lows... so all these points make it a strong breakout contender.

Now, we have to enter once that rejection candle’s high is taken out. Which it did after a few candles, resulting in a strong up move.

This setup basically tests the intention of the sellers, and only makes you enter a trade, only when the buyers soak up all the supply, which results in a high-probability move.

Another example:

Final Thoughts

Even though we talked about techniques and methods that will help you “avoid” fake breakouts, there’s really no way to avoid all of them, and this is the reality of the markets. The only certainty is uncertainty if that makes sense! You will have to accept this fact and just focus on taking high-probability trades and managing your risk.

Also, There’s a way to trade these “fake breakouts” if you want us to do a write-up on that topic as well, then do drop a comment.

Thanks for reading!

Learned something new about pre- empt.Waiting for newsletter of how to trade these “fake breakouts”

Superb explanation.